[car home Industry] has quietly left in 2023. Looking at the automobile market in 2023, it can be said that the word "volume" has been highlighted. From volume technology and price to volume going out to sea and volume cooperation, China automobile industry represented by new energy intelligent networked vehicles has entered a new development stage, and fierce competition is expected to continue to spread in 2024.

In mid-November, the relevant national ministries and commissions issued the Notice on Launching the Pilot Work of Intelligent Networked Vehicle Access and Road Access, formally proposing the L3/L4 automatic driving access norms and specific rules. The three cities of Beijing, Shanghai and Chongqing started the test, and many automobile enterprises obtained the test licenses, marking the official opening of a new stage of the intelligent process of automobiles. At the CES 2024 American Electronics Show held in Las Vegas, USA in early January, many car companies broke into the AI ? ? track and showed the latest technological breakthroughs. What kind of sparks will the auto industry collide with the hottest AI technology? Let’s wait and see.

Data description:

1. Intelligent electric vehicle: a vehicle with pure electric energy, plug-in hybrid power (including extended range) and intelligent driving level above L2;

2. Class L2: A vehicle equipped with an adaptive cruise system and a lane keeping assist system as standard is considered to have a level L2 intelligent driving level;

3. Weighted selling price of cars: based on the quotations of dealers all over the country, the weighted selling price of cars in the current month is calculated by weighting the proportion of car clues. The terminal quotation of the models on sale under the car series and the proportion of the models concerned by consumers will affect the monthly fluctuation of the weighted selling price of the final car series;

4. Source of data: Hot information comes from Sina Technology; Attention, clue number data, vehicle model data, new energy industry index data, etc. come from car home; Car sales come from market terminal sales data.

Download the full report and pay attention to WeChat official account of car home Research Institute. Just enter the keyword "Intelligent Electric Vehicle".

I. Market Sales Performance

■ Sales of new energy vehicles and smart cars reached the highest level in the whole year.

In December, the retail sales volume of the new energy vehicle market was 945,000 vehicles, up 47.3% year-on-year and 12.1% quarter-on-quarter. The new energy penetration rate exceeded 40% for two consecutive months, reaching 40.2%. In the last month of 2023, the domestic auto market was soaring, and many auto companies handed over the monthly sales results with obvious growth rate through price reduction measures. Looking at the annual sales results, only four car companies, Ideality, Geely, Lantu and BYD, have achieved their sales targets. Some of the car companies that have not achieved their targets are coming out of the trough, while others are weak. The 2023 report card has become a thing of the past, and the competition in the new year has just begun.

In December, Tesla introduced a subsidy policy of disguised price reduction. With the cyclical recovery of domestic delivery, Tesla Model Y and Model 3 delivered a total of 75,800 vehicles, and the sales of the two models ranked first and 13th in the new energy sales list. BYD has a total of six cars among the top ten in the new energy sales list, namely Seagull, Yuan PLUS, Song PLUS new energy plug-in version, Qin PLUS plug-in version, Song Pro new energy plug-in version and Dolphin. In addition, Wuling Binguo and Hongguang MINIEV are among the top ten in the sales list, ranking seventh and tenth respectively. It is worth noting that after climbing the production capacity, M7 delivered a total of 25,545 new cars.

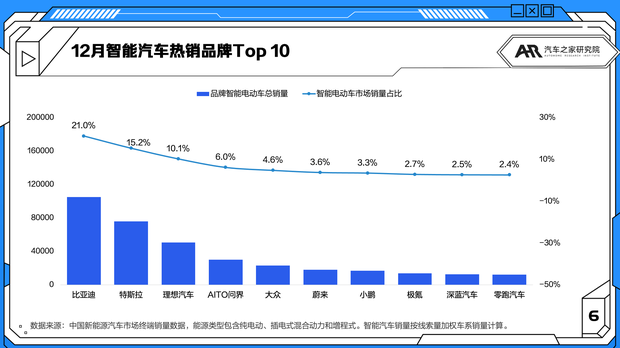

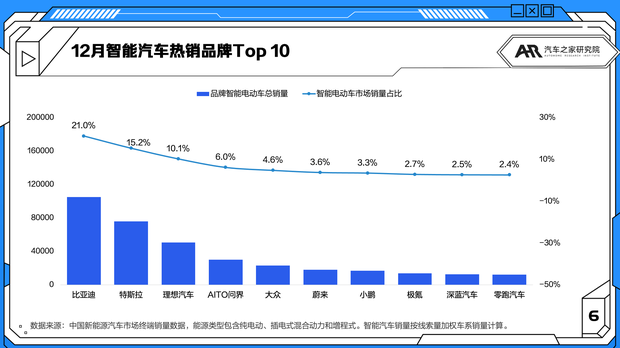

In December, Top 5 smart car brands were BYD, Tesla, LI, AITO and Volkswagen. Among them, AITO asked the public to surpass the public and ranked fourth in the smart car sales brand list. Among them, BYD’s market share declined, accounting for 21.0% of the total sales of smart electric vehicles, down from the previous month. BYD’s sales volume exceeded 300,000 in December, but the proportion of smart cars declined.

Looking at the sales rankings of various cars of smart electric vehicles, Model Y still ranks first, while Model 3 falls to fifth place. The world M7 and the ideal L7 rank second and third respectively, forming the most direct competitive encounter. In the face of M7′ s offensive, Ideal L7 also responded, and recently introduced some preferential policies. In addition, Ideal L8 and L9 also rank sixth and seventh in the smart car sales list. BYD’s smart car with the highest sales volume is the Song Pro new energy plug-in version, and Yuan PLUS and Han are also among the top ten smart car sales rankings. In terms of brand types, Wenjie M7, Volkswagen ID.3 and Model Y ranked first in China brand list, overseas mainstream brand list and overseas luxury brand list respectively.

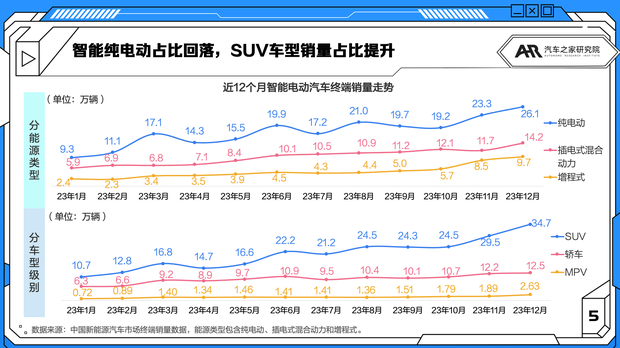

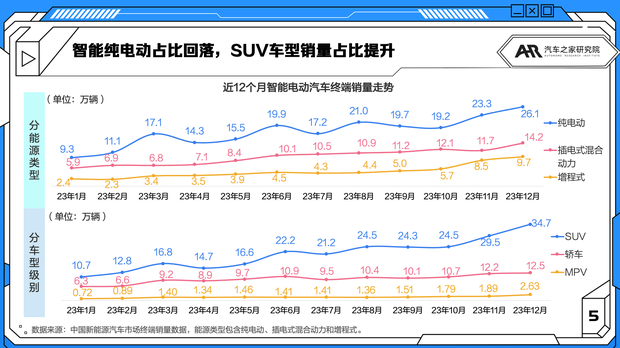

■ The proportion of smart plug-in hybrid cars has increased, while the proportion of car sales has decreased.

In December, the sales volume of smart electric vehicles increased by 14.4% month-on-month to 499,000 units, the highest since statistics. In terms of energy types, the sales volume of pure electric vehicles declined, accounting for 52.2%. Except for Tesla’s two pure electric vehicles, the sales volume of BYD’s Song PLUS new energy and Yuan PLUS smart pure electric models decreased. The proportion of mixed sales has rebounded to 28.4%, which is represented by the sales growth of BYD Song Pro New Energy and Hanhe Tang New Energy.

In terms of models, the sales of smart electric vehicles of all models increased in December. Among them, the sales volume of smart car models decreased by 2.9 percentage points to 25.1%, which was mainly due to the limited growth of several smart car models such as Model 3, Volkswagen ID.3 and BYD Han. In contrast, the smart SUV models represented by Model Y, Wenjie M7, Ideal L7 and Song Pro all increased by more than 20%. Among MPV models, the newly listed Chuanqi E8 and Polar Fox Koala both had excellent sales growth in December, ranking second and third in the sales list of smart MPV after Tengshi D9.

Second, the heat of automobile consumption

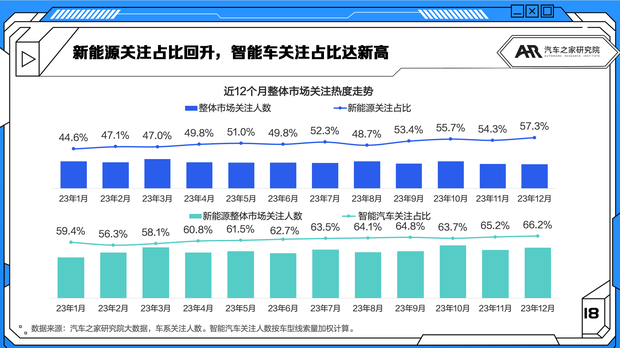

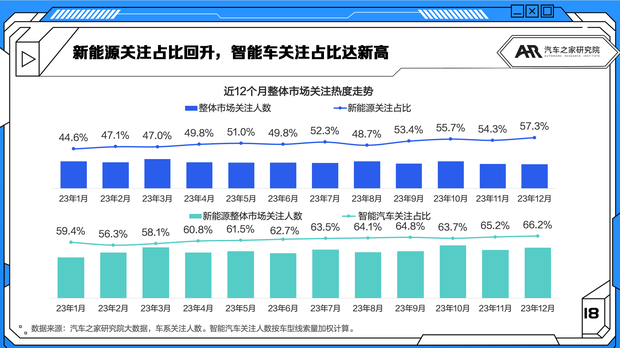

■ The proportion of new energy concerns has rebounded, and the proportion of smart cars has reached a new high

According to car home Big Data, the proportion of attention to new energy sources rebounded significantly in December, rising by 3.0 percentage points from the previous month to 57.3%, which was the highest level of attention since statistics, and increased by 14.9 percentage points compared with 42.4% in December last year. The number of people who pay attention to smart electric vehicles has also increased, and the proportion of attention has increased by 1.0 percentage points from the previous month to 66.2%, which is also the highest level in history, up by 8.3% compared with 57.9% in December last year. The two data basically maintained a growth trend throughout the year, and also accumulated kinetic energy for the new energy and smart electric vehicle market in 2024.

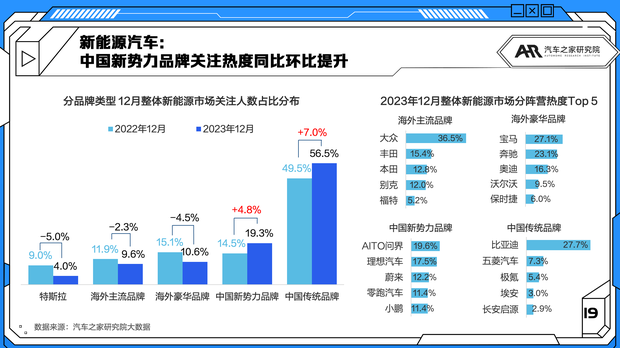

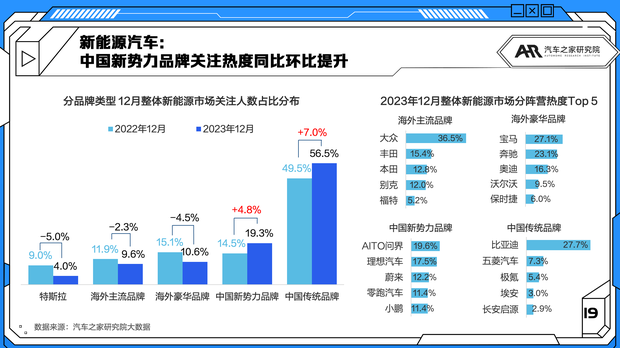

■ New energy vehicles: The attention of China’s new power brands has increased year-on-year

In the overall new energy market, the proportion of Tesla’s attention to heat decreased significantly year-on-year, and the chain was the same as that in November, which was 4.0%. The brand attention of China New Power increased by 4.8 and 1.6 percentage points year-on-year to 19.3% respectively. After a year of competition and a major reshuffle, the new power brands have once again proved their competitiveness and their market position has been continuously consolidated.

In terms of specific brands, among overseas mainstream brands, Buick’s popularity of E5 listed in October declined, and Honda surpassed it, falling to the fourth place in the list of overseas mainstream brands, while Ford was ranked fifth because of the new Ford electric car’s immediate launch. Among the new power brands in China, Wen Jie launched M9 in December after the new M7, which received great attention, and the popularity of attention surpassed LI in one fell swoop, ranking first in the new power brand list. The top five overseas luxury brands and traditional brands in China have not changed.

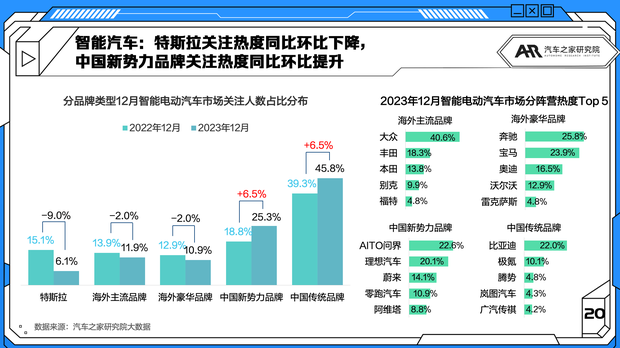

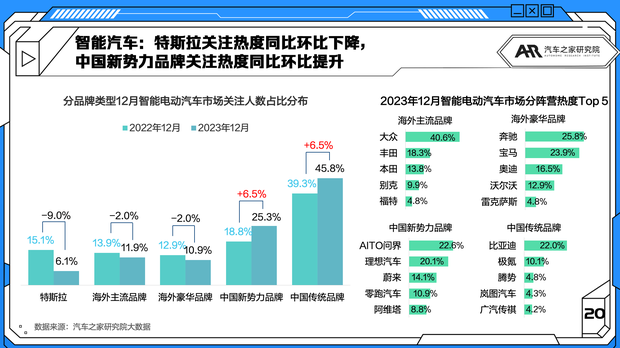

■ Smart cars: Tesla’s attention to heat decreased year-on-year, and China’s new power brands’ attention increased year-on-year.

In the smart electric vehicle market, after a year of industry evolution, the attention of overseas brands has declined to varying degrees, and the market attention share has given way to new forces and traditional brand car companies in China. The brand of China New Power, which is in a good development momentum, not only increased the proportion of attention heat by 6.5 percentage points year-on-year, but also maintained growth for several months, accounting for more than a quarter of the market attention heat. Among them, the most vigorous growth momentum is represented by asking for boundary M9, ideal L7, intellectual boundary S7, zero run C11, etc. In the second half of the competition between new forces and automobile enterprises, we can see more figures from traditional automobile enterprises, such as Wen Jie, Zhi Jie, Aouita, etc. The market structure of new forces has changed.

In terms of specific brands, among overseas luxury brands, Lexus launched the new Lexus RZ, which gained a certain degree of attention and ranked fifth in the list. Among the new power brands, Zero Run and Aouita both have newly listed new models, and their attention ranks fourth and fifth on the list. Among the traditional brands in China, Lantu ranked fourth in the list of traditional brands in China with the launch of Lantu Dreamer and the new model of chasing light in December. It is worth noting that Lantu, which has always been relatively low-key, has gradually been recognized by consumers. In December, it delivered more than 10,000 vehicles and became one of the only four brands to achieve the annual sales target.

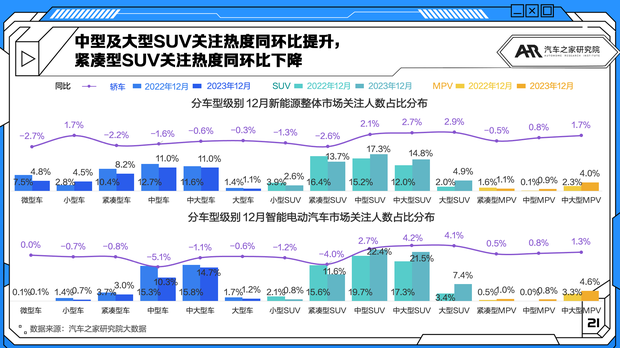

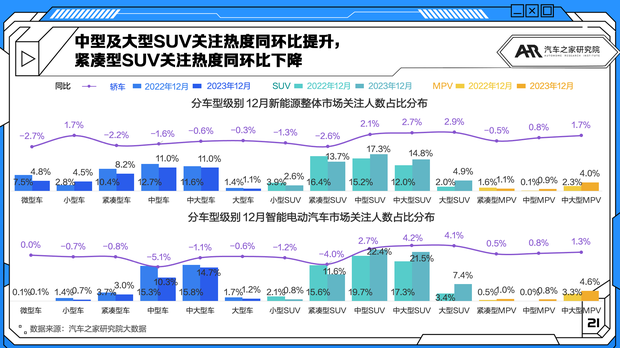

■ The heat of medium-sized and large-sized SUVs increased with the same period of last month, while that of compact SUVs decreased with the same period of last month.

In terms of vehicle types, in the overall new energy market, the most intense competition is SUV track, and the attention heat of medium-sized and large-sized SUVs has increased compared with the previous month, and the attention heat of medium-sized SUVs has reached 17.3%, among which, Model Y, Zero Run C11, Equation Leopard 5, and the newly listed BYD Song L are the representatives. The attention of compact SUVs decreased by 2.6 and 1.4 percentage points year-on-year to 13.7%.

Looking at the smart electric vehicle market, in the past year, the attention of all types of cars has declined, and the attention of SUVs has gradually moved to a higher level. The attention of small and compact vehicles has decreased year-on-year, and the attention of SUVs above the medium level has increased significantly year-on-year. The large SUV increased by 4.1 and 2.7 percentage points to 7.4% respectively from the same period of last month, and it has a certain market position. The representatives who entered this level of market, such as Wenjie M9, BYD Wangwang U8 and Ideal L9, ranked in the top three, showing the industry confidence of China new energy brand cars.

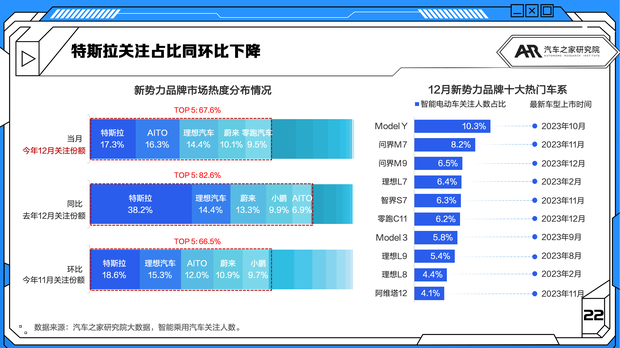

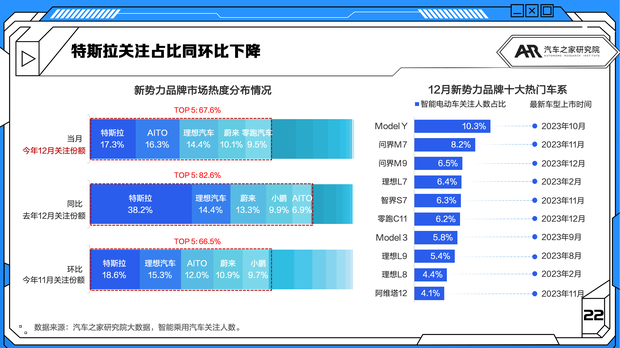

■AITO asks the world to surpass the ideal and approach Tesla’s attention.

Looking at the heat distribution of the new power brand market, the proportion of TOP5 brand attention increased slightly to 67.6%. Thanks to the joint efforts of M7 and M9, AITO’s attention exceeds the ideal in one fell swoop, with a gap of only 1 percentage point from Tesla. Zero-run cars also pushed Tucki out of the top five by virtue of the popularity of new models.

Among the top ten popular car series, the car series M7 and M9 ranked second and third after Model Y, and the car series S7 of Zhijie also showed sufficient competitiveness. After entering the eighth place in the top ten popular car series last month, it rushed to the fifth place this month. Huawei’s technological blessing has become a strong force in the field of smart cars. The independence of Huawei Car BU and the introduction of cooperation between car companies will also become a far-reaching event in the smart car industry in 2024.

Third, intelligent product analysis

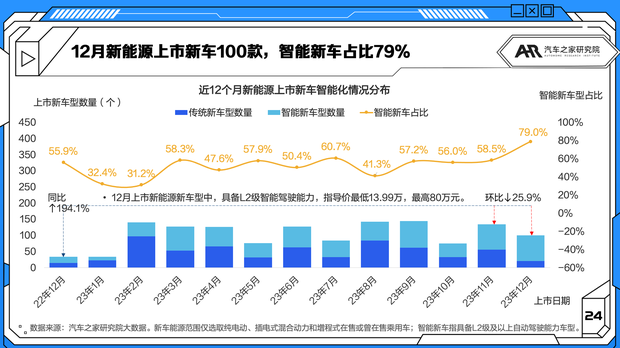

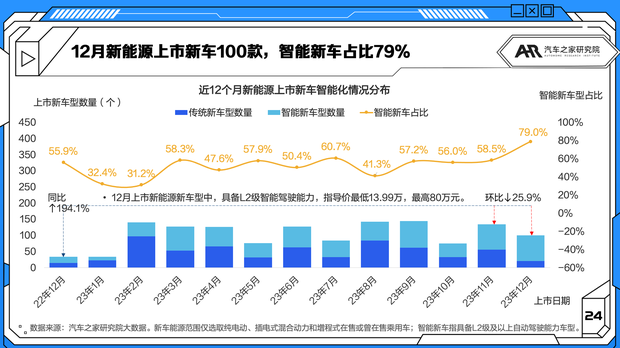

■ In December, 100 new energy vehicles were launched, and smart new vehicles accounted for 79%.

In December, 100 new cars were launched by New Energy, down 25.9% from the previous month and up 194.1% year-on-year. The intelligent allocation rate of new cars listed in December reached the highest in the whole year, with 79 smart new cars listed, accounting for 79%. Among the models with L2-level intelligent driving ability as standard in the new car, the lowest price is the 2023 125 Pro of Changan Qiyuan Q05, and the guide price is 139,900 yuan; The highest price comes from the 2024 basic model of Weilai ET9, and the guide price is 800,000 yuan.

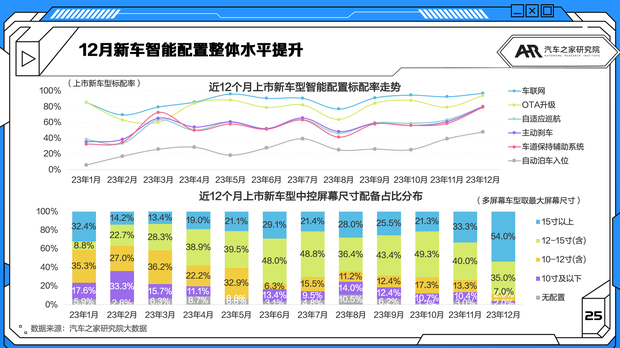

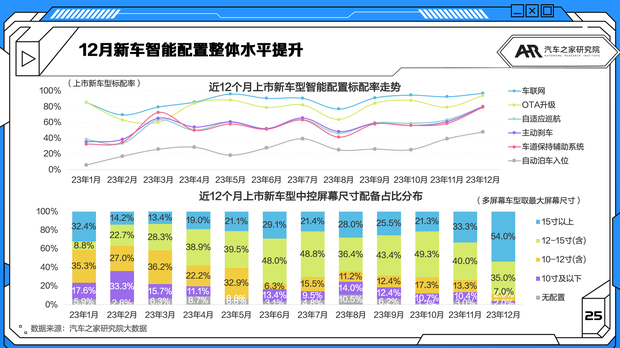

■ In December, the overall level of intelligent configuration of new cars was the highest in the whole year.

The level of intelligent configuration of new cars listed in December was 79%, and the overall level of intelligent configuration was the highest in the whole year. In the market, the "extremely cost-effective" self-driving scheme has been launched one after another. The configuration rates of Internet of Vehicles and OTA upgrades both exceed 94%; The configuration rates of active braking, adaptive cruise and lane keeping assistance systems are all around 80%; The allocation rate of automatic parking has also reached 48%, which is close to 50%. In terms of the size configuration of the central control screen in the car, the configuration ratio of the central control screen above 15 inches reached 54.0%. When L2-level intelligent driving gradually became the standard, L3-level self-driving entered the testing stage, and the smart car industry also started a new round of iterative upgrade from the beginning of 2024.

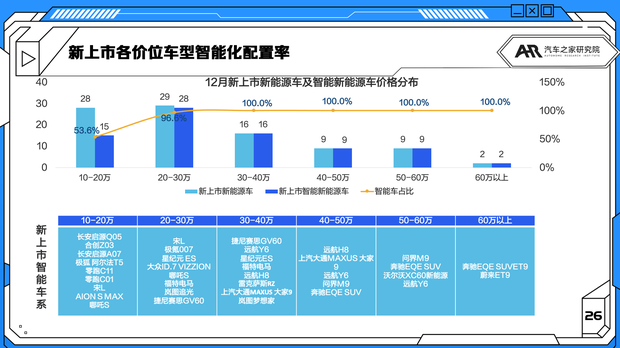

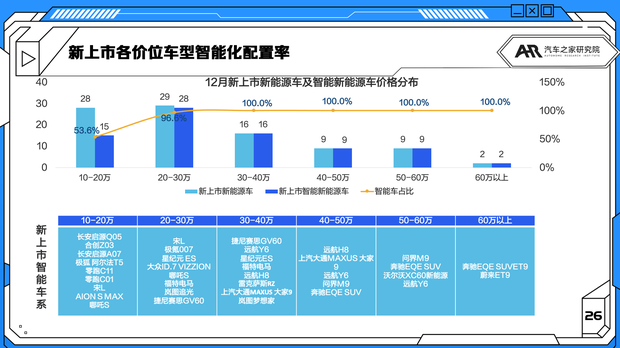

■ New cars listed above the price of 200,000 basically realize L2 self-driving configuration.

The following figure analyzes the distribution of new cars and smart new energy vehicles in each price range. Among the new energy vehicles listed in December, no model below 100,000 yuan has reached the standard of smart cars. The intelligent configuration rate of new cars with the price of 100,000-200,000 is 53.6%, and the intelligent models of new cars with the price of 200,000-300,000 are the most, with 28 models. Only one model has not achieved L2 self-driving configuration. The average guide price of smart new cars listed is 327,500 yuan, and the median is 289,900 yuan.

Fourth, the market price trend

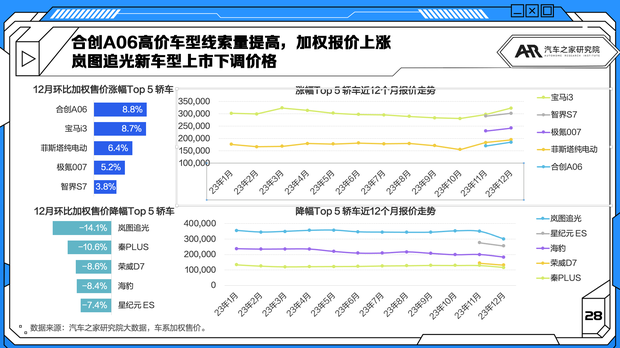

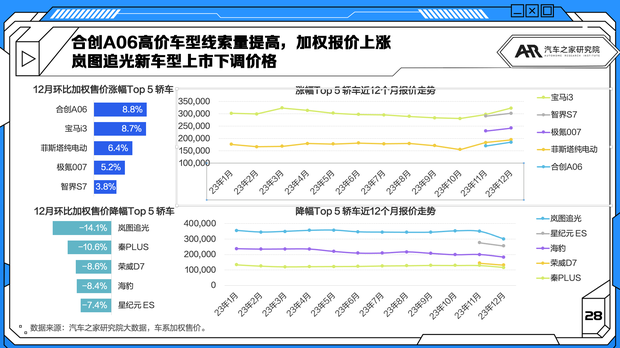

■ The number of clues of Hechuang A06 high-priced models has increased, and the weighted quotation has increased; Lantu chases light, new models go on the market, and prices are lowered.

In December, in order to offset the annual sales, car companies made price adjustments, and the overall price reduction level exceeded the price increase. The top five cars in the weighted price increase of new energy car market are Hechuang A06, BMW i3, Fista Pure Electric, Extreme Krypton 007 and Zhijie S7. Among them, Hechuang A06 is due to the increase in the number of clues of high-priced models, which has brought about an increase in the weighted selling price. BMW i3 is also due to the increase in the number of clues of high-priced models. However, according to car home Big Data, we can see that the dealer’s quotation of high-priced models has decreased, which brings a higher number of clues and indirectly raises the weighted selling price of the car series.

The top five cars with the decrease of weighted selling price are: Lantu Zhuiguang, Qin PLUS, Roewe D7, BYD Seal and Xingyue ES. The decline in the weighted selling price of Lantu Chasing Light is mainly due to the price reduction of new models. The decline in the weighted selling price of Qin PLUS is related to BYD’s preferential policy of offering a limited time discount of 10,000 yuan for low-priced models in December.

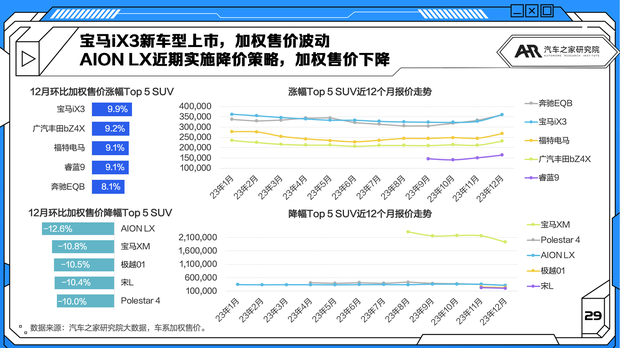

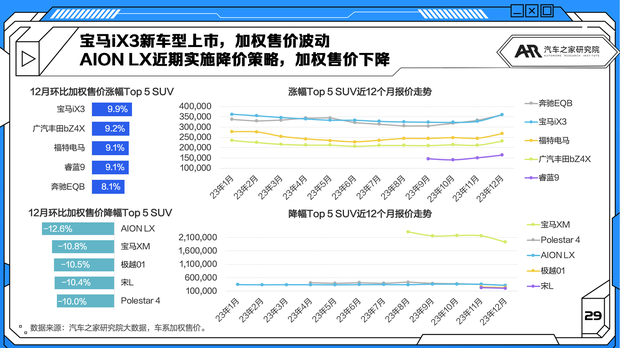

■ The new BMW iX3 model goes on the market, and the weighted selling price fluctuates; AION LX recently implemented a price reduction strategy, and the weighted selling price dropped.

Among SUVs, the top five cars with weighted price increases are BMW iX3, GAC Toyota bZ4X, Ford Electric Horse, Ruilan 9 and Mercedes-Benz EQB. Among them, the increase in the weighted selling price of BMW iX3 is due to the fluctuation of the weighted selling price brought by the listing of new models. GAC Toyota bZ4X is due to the increase in dealer quotations. The increase in the weighted selling price of Ford electric horse is due to the listing of new high-priced models.

The top five cars whose weighted selling prices have dropped are: AION LX, BMW XM, Extreme Yue 01, Song L and Polestar 4. Among them, AION LX is the decline of weighted quotation due to the preferential price reduction strategy of dealers. BMW XM, on the other hand, has brought down the weighted selling price due to the increase of clues of low-priced models.

V. Summary

In December, when car companies rushed to pursue the goal of the year, the sales volume reached the highest in the whole year, and the penetration rate of new energy passenger cars also stood firm at 40%. Although only four car companies completed the sales target in 2023, many car companies also handed in a unsatisfactory answer sheet. In 2023, there were many major events in the automobile industry, but the whole event revolved around the word "volume". Although 2023 has passed, the war of competition in the automobile market has not subsided. With the continuous improvement of the intelligent configuration ratio of new cars, the landing of L3-level self-driving test and the landing and promotion of new battery technology, a new round of technical cycle of intelligent electric vehicles has been started, and how technology, application, policy and market will promote each other in the future is worthy of our common concern. (Text/car home Research Institute)